April 16, 2024

Terri Miller, Consumer Education Specialist, FTC

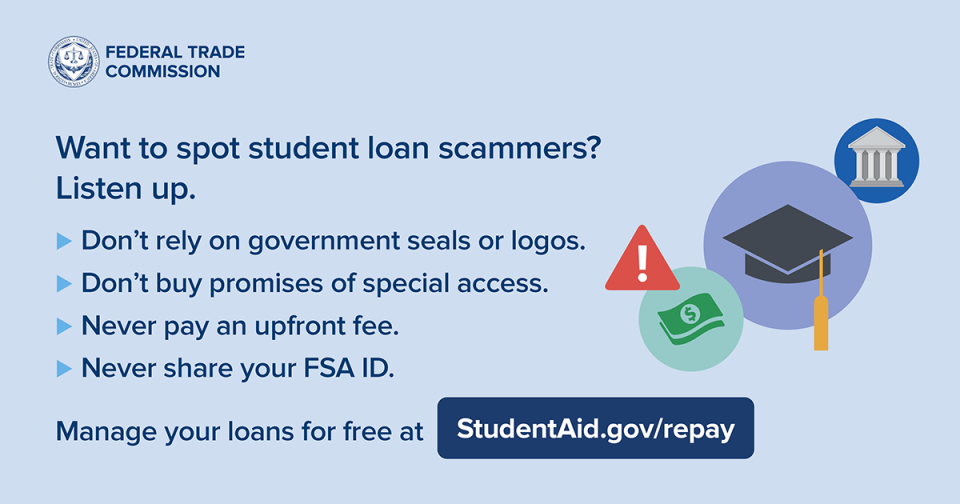

Hearing a lot about federal student loan forgiveness in the news? You’re not alone — scammers are, too. You might get a call from someone saying they’re affiliated with Federal Student Aid (FSA) or the Department of Education. (They’re not.) They’ll say they’re following up on your eligibility for a new loan forgiveness program, and might even know things about your loan, like the balance or your account number. They’ll try to rush you into acting by saying the program is available for a limited time. But this is all a scam. What else do you need to know to spot scams like this?

Read more >

April 2, 2024

Colleen Tressler, FTC, Division of Consumer and Business Education

April is Financial Literacy Month, and a great time to talk about consumer protection information that helps people avoid losing money to scammers. Federal Trade Commission data show people reported losing more than $10 billion to scams in 2023, marking the first time that fraud losses have reached that benchmark. It's now more important than ever to share information about spotting, avoiding and reporting scams. The free advice at ftc.gov/MoneyMatters will help you.

Read more >

March 7, 2024

Alvaro Puig, Consumer Education Specialist, FTC

One way to spot a scam is to understand its mechanics. A new and complicated scam starts with a call or text message about a suspicious charge on your Amazon account. But it’s not really Amazon. It’s a scammer with an elaborate story about fraud using your identity that ends with you draining your bank or retirement accounts.

Read more >

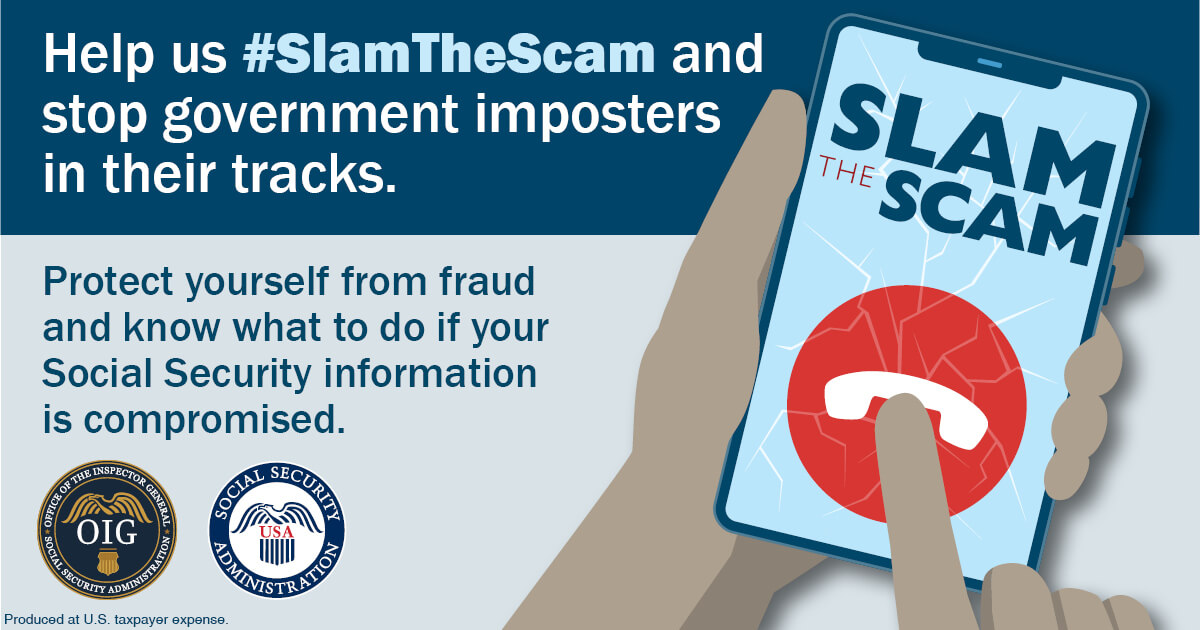

National Slam the Scam Day - March 7, 2024

National “Slam the Scam” Day is designated by Social Security’s Office of the Inspector General to raise awareness of government imposter scams, which continue to spread across the United States. Slam the Scam Day is Thursday, March 7, 2024, as part of National Consumer Protection Week, which takes place this year from March 3-9.

Read more >

February 27, 2024

Cristina Miranda, Consumer Education Specialist, FTC

If you’re in the checkout line with a gift card (or several) in your hand, ask yourself: is the gift card you’re buying for a gift? Or is someone on the phone with you as you’re checking out telling you what to do – like buy a gift card to pay for something and give them the numbers? Gift cards are ONLY for gifts. That means if the gift card isn’t for someone’s birthday, anniversary, or for any other gift giving reason, it’s a scam.

Read more >

February 14, 2024

Bridget Small, Consumer Education Specialist

When you have a new romance there’s so much to talk about. But if your new sweetheart only wants to talk about your money and how you should invest it, stop talking. They might be a romance scammer, like those who stole more than $1 billion from people last year. How do the scams start, and what can you do to avoid one?

Read more >

National Cybersecurity Alliance

Data privacy might seem abstract, but it couldn’t be more personal. You generate lots of data every time you access the internet, and sometimes, when you don’t – your home address, health records, and Social Security are all pieces of data. While you can’t control the fact that your data is collected, you can take charge of how and with whom you share data with in many cases.

Read more >

If you have a cell phone, you probably use it dozens of times a day to text people you know. But have you ever gotten a text message from an unknown sender? It could be a scammer trying to steal your personal and financial information. Here’s how to handle and report unwanted text messages.

Read more >

By Cristina Miranda

Consumer Education Specialist, FTC

December 20, 2023

What’s one way to keep your money safe from scammers during the holidays? If you’re in the check-out line buying gift cards, make sure they’re for gifts. Only gifts. Not because someone tells you to buy gift cards and give them the numbers off the back of the card. Only scammers say that.

Read more >

National Cybersecurity Alliance

With holiday shopping in full swing, we wanted to let you know about a few online shopping trends we’ve noticed and give a few tips about how to stay safe online while buying gifts for everyone on your list.

Read more >

How to Protect Yourself from AI Fraud

September 12, 2023

Artificial Intelligence (AI) fraud is the use of artificial intelligence to deceive or defraud individuals or organizations. Scammers create fake social media profiles and email addresses using false identities and/or footage. They’ll pretend to represent celebrities for soliciting money and information. Similarly, they may create phony websites or emails that appear to be from legitimate sources, including financial institutions or government agencies, and ask people to provide their personal information or login credentials.

To learn more about AI fraud and how to better protect yourself, below are links provided by the Federal Trade Commission.

Ads for fake AI and other software spread malicious software >

Scammers use AI to enhance their family emergency schemes >

June 13, 2023

Ari Lazarus, Consumer Education Specialist, FTC

Congratulations — it’s time to graduate! Whether you or someone you know is off to college in the fall, already has a job lined up, or is still figuring out next steps, there’s a lot to do to prepare. The FTC’s Financial Adulting 101 webinars and materials offer advice to help protect you or your favorite recent graduate from scams. Keep reading to learn more.

Read more >

March 30, 2023

Kira Krown Consumer Education Specialist, FTC

The “IRS” is on the phone. They’re saying you owe back taxes and need to pay immediately using cryptocurrency, or you’ll be arrested. You reach for your wallet but then think — WAIT — is this really the IRS? Or is it someone impersonating the IRS?

According to the latest FTC data, impersonation scams were the top reported scam in 2022. The FTC got more than 700,000 reports about impersonation scams, with one in five including loss of money.

Read more >

February 10, 2023

by Gema de las Heras Consumer Education Specialist, FTC

The devastation in Turkey and Syria following massive earthquakes is inspiring people to help and donate. And it’s prompting scammers — like they do after every disaster — to take advantage of your generosity. Find out how to make sure your money helps people in need.

Read more >

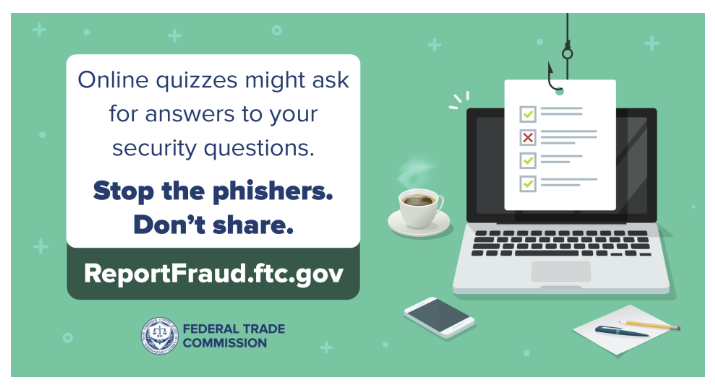

December 5, 2022

by Kira Krown, Consumer Education Specialist, FTC

What do the model of your first car, your favorite hobby, and the high school you attended have in common? If you said they’re questions commonly used for online account security and online quizzes, you’re correct! Before you take a quiz to find out which Marvel character you are, ask yourself: Do I know who’s gathering this information about me — or what they plan to do with it?

Read more >

December 5, 2022

by Kira Krown, Consumer Education Specialist, FTC

Looking for a New Year’s resolution? Here’s one for you: Keep your hard-earned money safe from scammers by spotting and avoiding gift card scams. Then help others spot and avoid them, too. Scammers want you to pay with gift cards because they’re like cash: once you use a gift card, the money on it is gone. But what do gift card scams look like?

Read more >

October 3, 2022

by K. Michelle Grajales, Attorney, Division of Financial Practices

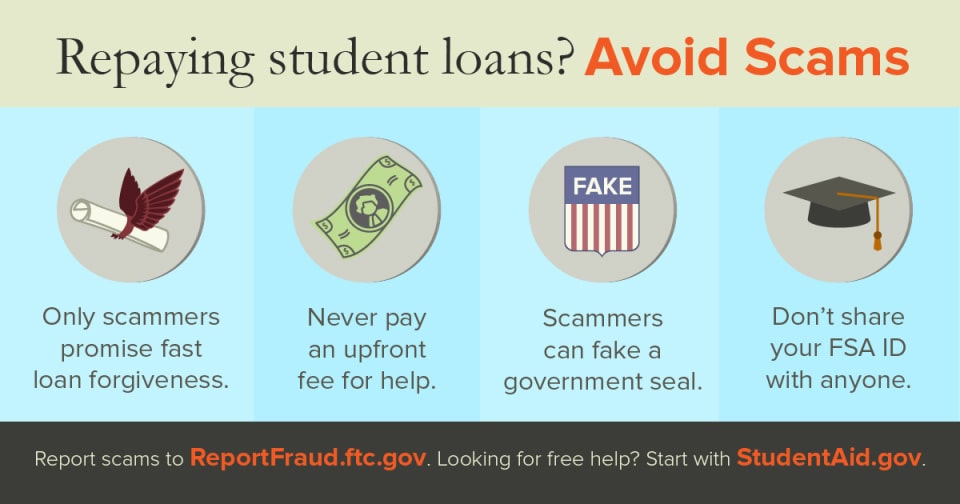

With the recent announcement of the one-time federal student loan debt relief plan, we knew scammers were on their way. Well, they’re here. The application for debt relief is rolling out any day now, so focus on getting information directly from the Department of Education.

But what do these student loan scams look like?

Read more >

August 10, 2022

by Joseph Ferrari

The FTC has been getting reports of people getting letters in the mail from a law firm. They are, they say, looking for the heir of a multi-million-dollar inheritance. And they think it might be you. (Spoiler alert: it’s not.)

Here’s what they offer: they’ll split the inheritance between you, their law firm, and some charities. One other thing: they say you have to keep this information secret and reach out to them by email — immediately.

Read more >

Scammers pressure you to wire money to them because it’s easy to take your money and disappear. Wiring money is like sending cash — once it’s gone, you probably can’t get it back. Never wire money to a stranger — no matter the reason they give.

Read more >

May 27, 2022

by Terri Miller

The U.S. Department of Education recently announced another extension of the student loan payment pause. This time the pause runs through August 31, 2022. That news puts student loans back in the headlines, along with discussion of some possible, eventual loan forgiveness for all. So, can scammers be far behind? No. No, they can’t.

In fact, student loan debt relief scammers are already here. But a federal student loan forgiveness program for all borrowers is NOT. Scammers might promise a loan forgiveness program — that most people won’t qualify for. Or they might say they’ll wipe out your loans by disputing them. But they can’t get you into a forgiveness program you don’t qualify for or wipe out your loans.

Read more >

May 9, 2022

by Andrew Rayo

With technology, it’s easier than ever to connect with others and people are just a click or call away. Nobody knows that better than scammers — who might try to contact you about a supposed virus or malware they’ve “found” on your device. So, during this Older Americans Month, remember — if someone unexpectedly calls or messages you, claiming your computer’s security is at risk, it’s a scam.

Read more >

March 14, 2022

by Jennifer Leach

Assistant Director, Division of Consumer and Business Education, FTC

Scammers are back at it, pretending to be FTC Commissioner Rebecca Kelly Slaughter and staff at the FTC. They’re emailing, saying there’s an award ready to be collected (for a fee), or an outstanding COVID issue requiring your immediate attention (and, ultimately, money). But it’s NOT the FTC emailing. And even if they switch to phone calls or the messages switch, those are scammers.

Read more >

February 4, 2022

by Jennifer Leach

Assistant Director, Division of Consumer and Business Education, FTC

Lots of people recently got an email or letter about free credit monitoring through the Equifax settlement. That’s because the settlement with Equifax was just approved by a court. So now, if you signed up for credit monitoring as part of that settlement, you can take a few steps to switch it on. The email or letter tells you how. Learn more at the FTC’s official site for information: ftc.gov/Equifax.

Read more >

February 3, 2022

by Seena Gressin

Attorney, Division of Consumer and Business Education

During Identity Theft Awareness Week 2022, we’ve talked about reducing your risk of identity theft. Credit freezes and fraud alerts can help. Both are free and make it harder for identity thieves to open new accounts in your name. One may be right for you.

Read more >

February 2, 2022

by Alvaro Puig

Consumer Education Specialist, Division of Consumer and Business Education

Taking steps to protect your personal information can help you minimize the risks of identity theft. But what if a thief gets your information anyway? Here are some of the ways thieves might use your stolen information and signs you can look out for.

Read more >

December 3, 2021

by Bridget Small

Consumer Education Specialist, FTC

Scammers are looking for people to help them move stolen money. They visit dating, job search, and other sites, tell fake stories, and make up reasons to send you money. Then they tell you to send the money to someone else. If you help a scammer move stolen money — even if you didn’t know it was stolen — you could get into legal trouble.

Read more >

by Seena Gressin

Attorney, Division of Consumer & Business Education, FTC

Have you gotten an alarming text message about your unemployment insurance benefits from what seems to be your state workforce agency? You’re not alone. Identity thieves are targeting millions of people nationwide with scam phishing texts aimed at stealing personal information, unemployment benefits, or both.

Read more >

After more than a year of pandemic-related devastating losses — including job losses – you may be one of millions looking to get back on your feet with a new job. This Financial Literacy Month, as always, the FTC wants to help keep you on track with ways to avoid job scams.

Read more >

February 1, 2021

The challenges that COVID-19 has brought include a higher risk of identity theft. In 2020, the FTC got about 1.4 million reports of identity theft, double the number from 2019. Repeatedly, identity thieves targeted government funds earmarked to help people hard hit financially by the pandemic. Join us for Identity Theft Awareness Week, February 1-5. Learn about protecting yourself from identity theft, and recovering if it happens to you

Learn More >>

It’s Financial Literacy Month:

Learn how to keep your money safe.

|

A caller deliberately falsifies the information transmitted to your caller ID display to disguise their identity. Scammers often use neighbor spoofing so it appears that an incoming call is coming from a local number, or spoof a number from a company or a government agency that you may already know and trust. If you answer, they use scam scripts to try to steal your money or valuable personal information, which can be used in fraudulent activity.

Learn More >

Living through the pandemic has transformed our personal and professional lives. While some of us continue to work from home, others are interviewing for their first job, and still others are seeking a new career path. Finding a place to live, whether buying a home or renting a place to live can be financially challenging. Transportation costs may have some of us rethinking where we want to live and the kind of jobs we want. And, as we work to regain our financial footing, scammers will continue to try to steer us off course and steal our money and personal information.

Learn More >

Learn More About Fraud Prevention in the Digital Age

We've provided these helpful materials so you can identity warning signs and avoid the hassle and worry that comes with fraudulent activity on your account.

FBI Announcements:

Updated September 20, 2017

Equifax Data Compromise Alert – What You Can Do

The recent Equifax Data Compromise is reported to have affected 143 million consumers. To find out more about the Equifax compromise and to find out if you were impacted, you can visit the Federal Trade Commission (FTC) site. Equifax also has a dedicated group to provide additional information on steps you can take to protect your personal information. Equifax recommends that consumers contact their dedicated call center toll-free at (866) 447-7559. The call center is open 7 days a week from 7:00 am – 1:00 am Eastern Time.

Get Your Free Credit Report

You can receive a free credit report once a year from each of the three major credit bureaus at annualcreditreport.com.

You Can Freeze Your Credit

If you are interested in initiating a credit freeze or credit alert, you can visit the Federal Trade Commission's (FTC) dedicated Credit Freeze FAQs. Fees may apply.

If you believe you've been a victim of fraud or identity theft, contact us immediately at (800) 537-8491.

The Internet Crime Complaint Center (IC3) continues to receive reports from individuals who have received extortion attempts via e-mail related to recent high-profile data thefts.... Click here to continue >>

Each year, criminal actors target US persons and visa holders for Stolen Identity Refund Fraud (SIRF)... Click here to continue >>

As previously reported by the media in and after July 2015, security researchers evaluating automotive cybersecurity were able to demonstrate remote exploits of motor vehicles... Click here to continue >>

September 14, 2023

Ari Lazarus, Consumer Education Specialist, FTC

You’ve probably heard the news — federal student loan repayments are starting again in October. But scammers might try and tell you they can help you avoid repayment, lower your payments, or get your loans forgiven — for a price. Here’s how to spot and avoid these scams.

Read more >