|

IMPORTANT ALERT: Recently, there’s been an increase in fraudulent activity where fraudsters claiming to be from First Financial Credit Union with one goal—to get your account and other identification information. If you receive a phone call, text or email message asking for your information, do not respond. Please report it immediately by calling us at (800) 537-8491 so we can assist you. |

Don't Hang On, Hang Up!

Scammers frequently employ illicit spoofing methods to conceal their identity when making calls, sending false information to your caller ID. They resort to various tactics, like using local area codes and numbers that appear familiar, or impersonating reputable entities you regularly interact with, such as local utilities or government agencies, all in an attempt to deceive you into answering their calls.

Here are some quick tips:

Don't trust caller ID alone:

Caller ID information can be manipulated through spoofing. Even if the call appears from a familiar number or organization, it's not a guarantee of authenticity.

We will never asks for personal information like your full credit card number, PIN, password, etc.

Verify identities:

If the caller claims to represent a company or organization you're familiar with, ask for addtional verification or call the company directly using a trusted phone number to confirm the legitimacy of the call.

If you're unsure we are calling you—feel free to hang up and call us directly at (800) 537-8491. Don't worry, if you hang up on our legitimate call, we know it's for your own protection.

Be skeptical of urgent requests:

Scammers often create a sense of urgency to pressure you into taking immediate action. Take your time to evaluate the situation and verify the legitimacy of the call before providing any information or making any payments.

Stay aware:

Stay informed about common scam tactics and be aware of the latest trends in spoofing and other fraudulent activities. Knowledge is your best defense against falling victim to scams.

Use call-blocking apps:

Consider using call-blocking apps or services that can help identify and block suspicious calls, including those using spoofing techniques.

iPhone | Galaxy | Pixel

Report suspicious activity:

If you receive a suspicious call, report it to the appropriate authorities, such as the Federal Trade Commission (FTC) or your local consumer protection agency. This can help prevent others from falling victim to the same scam.

|

July 8, 2024

Terri Miller Consumer Education Specialist, FTC

Did someone supposedly spot fraud or criminal activity on one of your accounts? Did they offer to help “protect” your money by moving it from your bank, investment, or retirement account? Maybe they even asked you to share a verification code? If anyone did any of those things, it’s always a scam. So, what do you do next?

Read more >

June 28, 2024

Ari Lazarus, Consumer Education Specialist, FTC

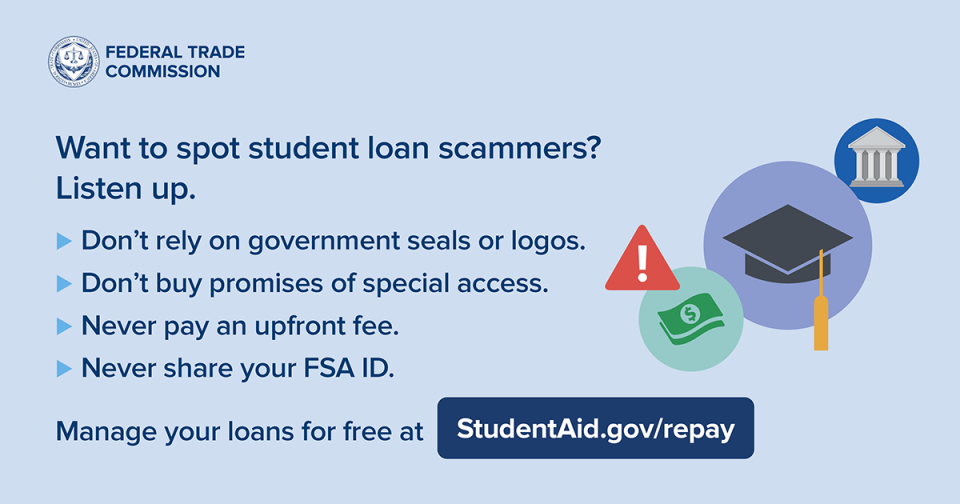

Some student loan debt relief companies will lie and say they’re affiliated with the Department of Education when they’re not. They want their bogus claims of “guaranteed” loan forgiveness (for a fee) to seem more legitimate (they’re not).

Read more >

Terri Miller, Consumer Education Specialist, FTC

When you log into your bank or credit card account, you might get a text message or email with a verification code. You then enter it at the login screen to confirm it’s really you. That’s a form of two-factor authentication that adds a layer of security to your account — and keeps would-be scammers and hackers out.

Read more >

Colleen Tressler, Consumer Education Specialist, FTC

Imposter scams often begin with a call, text message, or email. The scams may vary, but work the same way – a scammer pretends to be someone you trust to convince you to send them money or share personal information.

Read more >

April 16, 2024

Terri Miller, Consumer Education Specialist, FTC

Hearing a lot about federal student loan forgiveness in the news? You’re not alone — scammers are, too. You might get a call from someone saying they’re affiliated with Federal Student Aid (FSA) or the Department of Education. (They’re not.) They’ll say they’re following up on your eligibility for a new loan forgiveness program, and might even know things about your loan, like the balance or your account number. They’ll try to rush you into acting by saying the program is available for a limited time. But this is all a scam. What else do you need to know to spot scams like this?

Read more >

March 7, 2024

Alvaro Puig, Consumer Education Specialist, FTC

One way to spot a scam is to understand its mechanics. A new and complicated scam starts with a call or text message about a suspicious charge on your Amazon account. But it’s not really Amazon. It’s a scammer with an elaborate story about fraud using your identity that ends with you draining your bank or retirement accounts.

Read more >

February 27, 2024

Cristina Miranda, Consumer Education Specialist, FTC

If you’re in the checkout line with a gift card (or several) in your hand, ask yourself: is the gift card you’re buying for a gift? Or is someone on the phone with you as you’re checking out telling you what to do – like buy a gift card to pay for something and give them the numbers? Gift cards are ONLY for gifts. That means if the gift card isn’t for someone’s birthday, anniversary, or for any other gift giving reason, it’s a scam.

Read more >

February 14, 2024

Bridget Small, Consumer Education Specialist

When you have a new romance there’s so much to talk about. But if your new sweetheart only wants to talk about your money and how you should invest it, stop talking. They might be a romance scammer, like those who stole more than $1 billion from people last year. How do the scams start, and what can you do to avoid one?

Read more >

National Cybersecurity Alliance

Data privacy might seem abstract, but it couldn’t be more personal. You generate lots of data every time you access the internet, and sometimes, when you don’t – your home address, health records, and Social Security are all pieces of data. While you can’t control the fact that your data is collected, you can take charge of how and with whom you share data with in many cases.

Read more >

If you have a cell phone, you probably use it dozens of times a day to text people you know. But have you ever gotten a text message from an unknown sender? It could be a scammer trying to steal your personal and financial information. Here’s how to handle and report unwanted text messages.

Read more >