Checking

Your checking account is a go-to tool you use every day. Make sure you get one that fits your lifestyle and lets you manage money your way.

Free Convenience Checking

With this straightforward checking account, you can manage money the way you want, using all the digital tools you need.

- Open with a $25 minimum deposit

- Keep any balance after that

Prime Checking

If you typically keep a larger balance in your checking account, Prime Checking lets you earn interest at a competitive rate without any extra effort.

- Open with a $100 minimum deposit

- Your balance grows at 0.10% Annual Percentage Yield (APY)

Junior Checking

Our Junior Checking allows your teen (age 13–17) to engage with their own checking account, giving them real-life, hands-on experience of budgeting, spending, and saving responsibly.

- No monthly minimum balance requirement

- No monthly service fee

- Securely transfer funds to your teen from another FFCU account

Get a checking account that checks your boxes

Open a checking account that lets you keep any balance you want, or go with one that earns interest. Whatever features you want in your checking account, you'll find the right one, right here. Both of our checking accounts come with access to Online/Mobile Banking and Mobile Check Deposit so you have all the digital tools you need to move money and monitor your account anytime, anywhere.

- Earn discounts on our auto and real estate loans1

- Earn higher yields on SuperSavers2

- Includes a Visa Debit Card with access to more than 30,000 surcharge-free CO-OP ATMs nationwide

- 24/7 fraud protection with Visa's Zero Liability Policy4

- Free eStatements for quicker, more secure access to your monthly statements

Choose the Checking You Want

Our various checking options are designed to help you reach your goals!

Compare Accounts

| Types of Checking Accounts | Minimum Opening Deposit | Annual Percentage Yield (APY) | Minimum Balance to Earn Dividends and Avoid Fees |

|---|---|---|---|

| Free Convenience Checking | $25 | N/A | $0 |

| Prime Checking | $100 | 0.10% | $1,000 |

| Junior Checking | $25 | N/A | $0 |

Online Banking Alerts

Know what's going on with your account at all times by activating special alerts. You'll receive notifications to your email and/or mobile device* so you can keep track of your money.

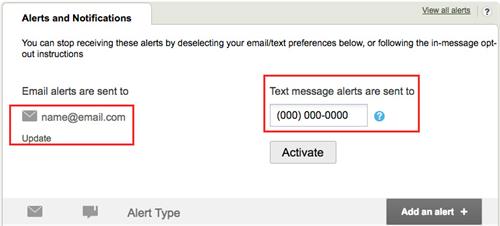

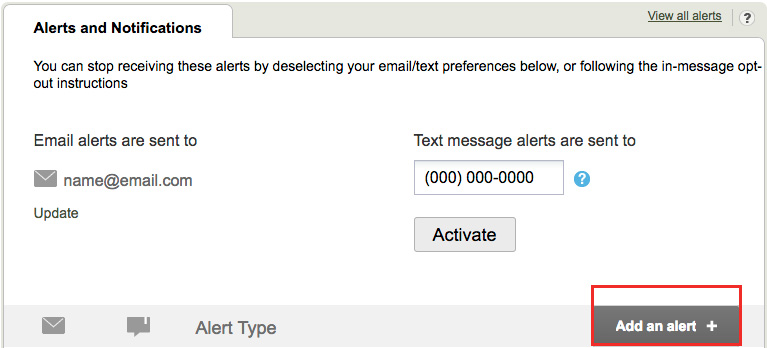

Set up Alerts & Notification

- Go to Online Banking and click on the Additional Services menu tab

- Click on Alerts & Notifications

- Update email and/or mobile phone number to receive the alerts

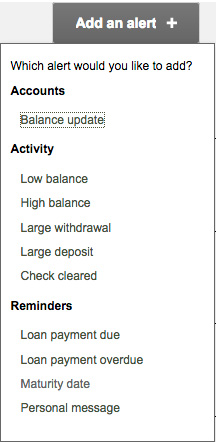

4. Click on Add Alert

5. Select alerts & notifications to add.

*Message and data rates from your mobile carrier may apply.

Lost or Stolen Visa Debit Card

- Call us at (800) 537-8491 or (888) 297-3416.

Activate Your Visa Debit Card

Please call us at (800) 537-8491 during normal business hours.

For after-hours, please call

- US: (800) 290-7893

- International: (206) 624-7998

Overdrafts and Overdraft Fees

An overdraft occurs when you do not have enough money in your account to cover a transaction, but we pay it anyway.

We can cover your overdrafts in two different ways:

- We have standard overdraft practices that come with your account.

- We also offer overdraft protection plans, such as a link to your Visa Platinum or a checking or savings account, which may be less expensive than our standard overdraft practices. To learn more, ask us about these plans.

This notice explains our standard overdraft practices.

What are the standard overdraft practices that come with my account?

We do authorize and pay overdrafts for the following types of transactions:

- Checks and other transactions made using your checking account number

- Automatic bill payments

We do not authorize and pay overdrafts for the following types of transactions unless you ask us to (see below):

- ATM transactions

- Everyday debit card transactions

We pay overdrafts at our discretion, which means we do not guarantee that we will always authorize and pay any type of transaction.

If we do not authorize and pay an overdraft, your transaction will be declined.

What fees will I be charged if First Financial Credit Union pays my overdraft?

Under our standard overdraft practices, the following will apply:

- Non-Sufficient Funds (NSF)- we will charge you a fee of up to $35 each time we pay an overdraft.

- However, we will not charge you an NSF fee more than 3 times per account per day (the maximum total NSF fee per account per day is $105 (3 x $35).

What if I want First Financial Credit Union to authorize and pay overdrafts on my ATM and everyday debit card transactions?

If you also want us to authorize and pay overdrafts on ATM and everyday debit card transactions:

- Log into Online Banking

- Click on Card eServices

- Click on the REG E Opt In/Out form.