Wire money online

Over the phone or at one of our branches

There are dozens of reasons you might want to send money quickly to someone in the United States. But there's one option that provides the speed, security and certainty you need – wire transfers. Get in touch with us and we'll help you send, or receive, money in a few steps.

Please note, we do not accept or send international wire transfers. We do not have a SWIFT Code. You may be able to receive an incoming international wire through an intermediary financial Institution. Please refer to the sending financial institution for additional information.

Before You Send A Wire Transfer

While convenient, wire transfers are most of the time irreversible. Knowing this, scammers will use wire transfers as a way of stealing money from unsuspecting people.

Don’t fall for it.

Before You Send A Wire Transfer

Before you send a wire transfer, make sure to verify the recipient. Check out the helpful resources from the Federal Trade Commission.

Find the important numbers

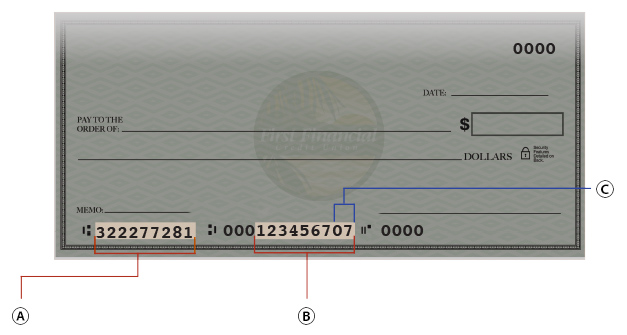

Here's where you can find our routing number and your member number on your checks.

- This is the Routing & Transit number for all First Financial Credit Union member accounts.

- This is where your Checking account number appears, plus an additional two-digit suffix.

- This is where you will find the two-digit suffix for your Checking account.

Here are examples for First Financial account suffixes:

|

Account Type |

Suffix Example |

|

Stakeholder (Savings) |

00 |

|

Convenience Checking |

07 |

The above examples of our suffixes may appear differently on your account. Please refer to your statements or call us (800) 537-8491.

Receive a wire

We charge a $10 fee for incoming wire transfers, which can be sent to your First Financial savings or checking account.

- What you’ll need to provide the person sending you a wire transfer:

- Your name

- Your First Financial account number + two-digit suffix

- Our routing (ABA) number: 322277281

- Our address: P.O. Box 5040, Pasadena, CA 91117

Send a wire

We charge a $25 fee for outgoing domestic wire transfers.

We can help you at (800) 537-8491, at your local branch or via Online/Mobile Banking chat. Use our Domestic Wire Transfer Request Form to get started.

If we receive your wire transfer request by 12:00 p.m. PT, you can expect it to process on the same business day. After 12:00 p.m. PT, your wire transfer will process on the next business day.

What you’ll need:

|

Your Information

|

Payee Information

(person receiving funds)

|

Transfer Information

|

|---|---|---|

| Name | Name | Transfer amount |

| Account number plus two-digit suffix | Address - if wire transfer is for over $3,000 | Additional wiring instructions (i.e. escrow #, property address, etc.) |

| Receiving financial institution name and address | ||

| Routing number (ABA) | ||

| Account number | ||

|

Intermediary Financial (if applicable)

|

Cancel your wire transfer

We can help at (800) 537-8491 or via Online/Mobile Banking chat.

If your wire transfer has not yet been processed (funds have not left your account): We can cancel your request if you contact us within our business hours, Monday – Friday, 7 a.m. – 7 p.m. and Saturday, 9 a.m. - 4 p.m.

If your wire transfer has been processed (funds have left your account): We can submit a reversal request to the payee’s financial institution to attempt to retrieve the funds, although there are no guarantees on outcome. Depending on the financial institution, reversal requests can be subject to fees.

There is no set time frame to receiving a response from the payee’s financial institution. We recommend contacting us five business days after a reversal request to check on the status.

Have Questions?

If you have any questions, please call us at (800) 537-8491, chat via Online/Mobile Banking, or visit your nearest branch.